How much should your Accounting firm pay for your server?

Imagine you’re about to buy a new car. For the past five years you have driven the family around in a big, seven-seater, Toyota Tarago people mover. Time in the car is spent carting your kids from sports matches to birthday parties.

Now, two of your four kids have moved out of home, backpacking around Asia and living on their own. A third is doing their final year exams and has plans to live abroad.

Next year it will be you, your spouse and the youngest. Are you really going to spend $50k on a Tarago again? Or will you get something that better suits your needs?

Many accountants are in the same position when it comes to evaluating their server. Like cars, the price of a server can vary wildly. You can spend $5,000 or $50,000 plus. However, the buying recommendation is not made by your independent-minded spouse. It is made by your IT services company, which often takes commission on the sale.

When it comes time to replace your server, you will often hear the argument, “You need to spend more than $15,000 because you don’t want your practice software to run slowly and stop your staff from working effectively.”

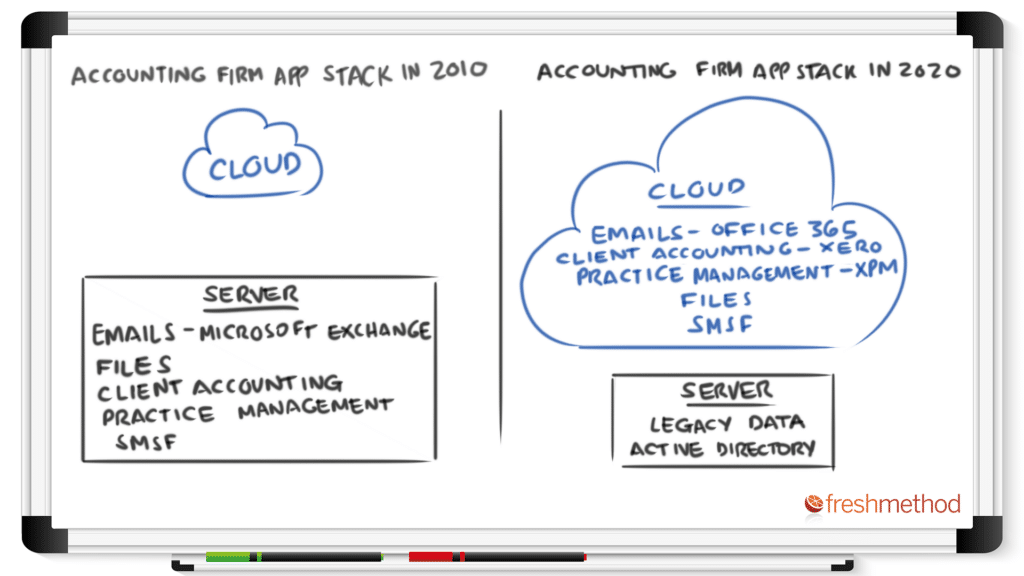

The reality is that for almost every firm, the number of applications on the server has dropped dramatically in the past 10 years. The unstoppable shift of business applications to the cloud means that the amount of work your server has to do to run your practice is decreasing, not increasing.

So why would you pay for the Toyota Tarago if you only have a handful of apps to cart around your network?

The Flight to the Cloud

In 2010:

- Email: Nearly every firm was built on Microsoft Exchange for email communications.

- File storage: Windows and maybe SharePoint for file management.

- Practice software: Another critical role for the server was running your practice software, the beating heart of workflow, job tracking and time billing.

- Accounting data files: Copies of all your clients’ accounting files such as MYOB and Reckon desktop software.

- Line-of-business tools: Tax and SMSF software also used to be server based.

- User access: One server application which many firms don’t realise they use is Microsoft’s Active Directory. This tool uses the identity of your employees to control their access to the network, server and software.

Fast forward to today and Microsoft has shifted its products to the cloud. Here’s a quick list of what’s available in 2020:

- Email: Very few firms would be running Microsoft Exchange for their email today. The cloud-based Microsoft 365 (formerly Microsoft Office 365) has become the default for email sending and storage.

- File storage: SharePoint has also moved online with drives syncing to desktops and laptops, like Dropbox does. (Many firms that haven’t optimised their Microsoft setup are still using file management on the server.)

- Line-of-business tools: SMSF and tax software are now available online, and receiving more features and upgrades than desktop equivalents.

- Accounting data files: A very high percentage of client files have moved online thanks to Xero, MYOB Essentials, Intuit QuickBooks Online and Reckon One.

- Practice software: A lot of small firms have switched from paid practice software to Xero’s free Xero Practice Manager, which is run online. MYOB and to a lesser extent Reckon have started releasing cloud modules for their practice software, which does still require a server to operate.

- User access: Now there is a cloud version of Active Directory too.

So what does that leave on the server? Depending on the size of your practice, or its appetite for change, you could consider permanently retiring the server entirely. If you have a larger firm you may still be using a server for practice software, line-of-business tools and file storage.

Plus you likely have desktop accounting data files for those clients that haven’t yet moved to the cloud.

Whatever is on your list, the number of reasons for owning a server will invariably be shorter – perhaps a lot shorter – than it was five or 10 years ago. In that same period, servers and their operating systems have become much more powerful, while dropping in price. An honest appraisal of your requirements should therefore recommend a smaller, more affordable server.

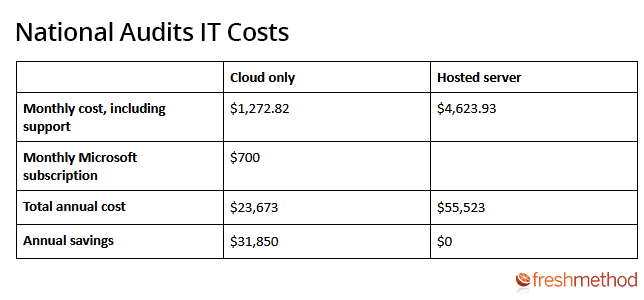

In a real-life example, National Audits, an 18-staff NSW firm with two offices, realised it could move their legacy data to online storage and ditch their expensive “private cloud” hosted server. The hosted server was vastly overpowered for the role it played in running the firm.

The monthly cost for the hosted server plus support was $4,626.93, or $55,523 a year. The online solution plus fast-response help desk was $1,272.82, plus a $700 a month bill to Microsoft for its cloud software for a total annual cost of $23,673.

The savings paid for the in-office server within six months. “Overall, the experience has been extremely positive. Our IT is working better than ever, and it doesn’t hurt to save over $25,000 in hard costs every year that can be put back into other things, including profit!” says Steve Watson, managing director of National Audits.

Not every firm stands to save $31,850 a year, or 57% of their previous IT bill, like National Audits. But as a general rule, removing a server by switching to cloud applications will make your IT setup much easier and cheaper to operate.

Why Hosted or Private Cloud May Not Make Sense

Let’s say that you have started to use cloud applications, if only with clients’ accounting files, such as Xero. But you still need to retain a server for practice software or just to hold legacy data from your old practice software before you switched to a cloud alternative.

Should you just ditch the physical server in your office and replace it with a hosted server instead? While this may appeal from an aesthetic or risk perspective, you need to assess the costs carefully. It may surprise you how expensive hosted services can be.

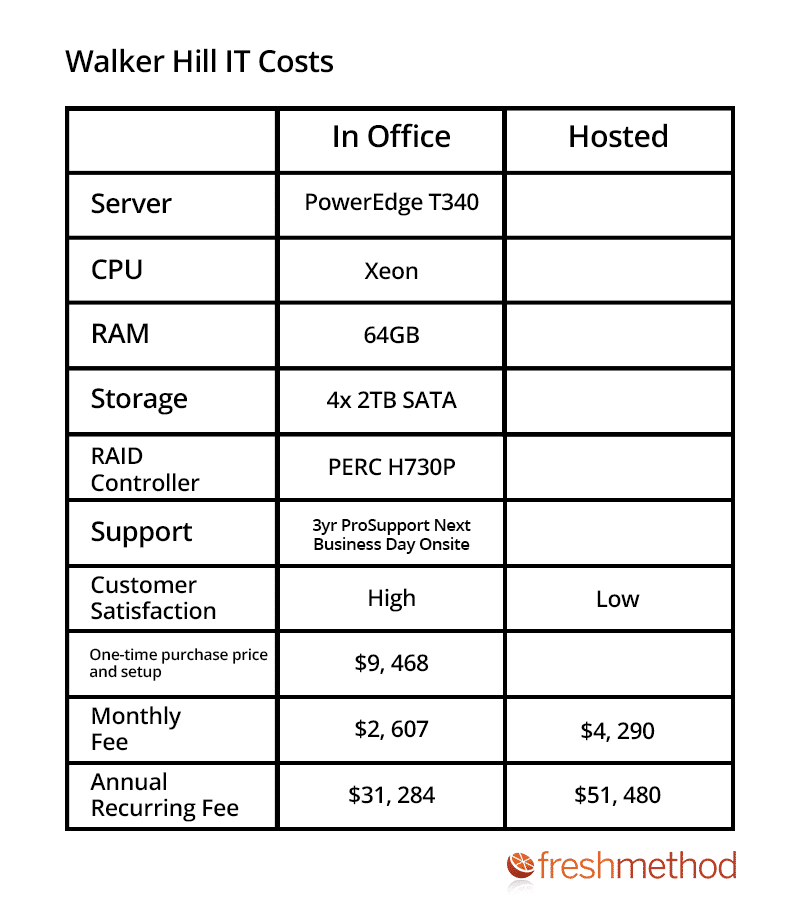

Brisbane-based firm Walker Hill was locked into a long-term hosted server contract, and despite the promises of easier management with a hosted solution, was having trouble with the speed of applications. The bundled price for the heavy-duty, hosted server came to $4,290 per month.

The 23-staff firm bought a smaller server to run in the office that could easily handle their requirements. The server purchase and setup cost $9,468, plus $2,607 for ongoing support that included a fast-response help desk.

In the first year, the in-office server and support contract cost $40,752 compared to the hosted solution at $51,480 – saving $10,728, or 21%. From the second year onwards, Walker Hill paid $31,284 versus $51,480 – saving $20,196, or 39%.

Some of the strongest arguments for moving to hosted servers have fallen apart in recent years. Hosted data centres do indeed have advantages: high-speed, redundant connections to the internet, sophisticated backup services, and replacement servers if your server crashes.

However, the NBN has dramatically reduced the cost of high-speed internet access. Setting up two connections from different suppliers, if required, is not difficult or expensive.

Servers have become much more reliable, cheaper and easier to use. The likelihood that a server will need attention has decreased enormously. Server technicians can work on servers remotely and reboot if required.

Likewise, backup technology is much more prevalent. Microsoft includes backup in its file storage, email and applications, and cloud backup services can provide assurance of business continuity.

From a financial perspective, as the role of the server decreases, the percentage of IT budget allocated to it should decrease too. Particularly as firms move faster to online applications for staff working at home through this pandemic.

Check The Price Matches Your Practice

There are plenty of firms that need to run a server and still do so in their office. Even if they have moved to cloud practice software such as Xero Practice Manager, they could use Active Directory to manage their employees and need access to an old copy of their server-based practice software.

The problem for accountants is that it is very difficult to know how much server you need for your situation. Unscrupulous or ignorant IT services companies are quoting enormous sums for servers that are far more powerful than required. In the family car analogy, they’re recommending a $120,000 Porsche Cayenne for a milk run.

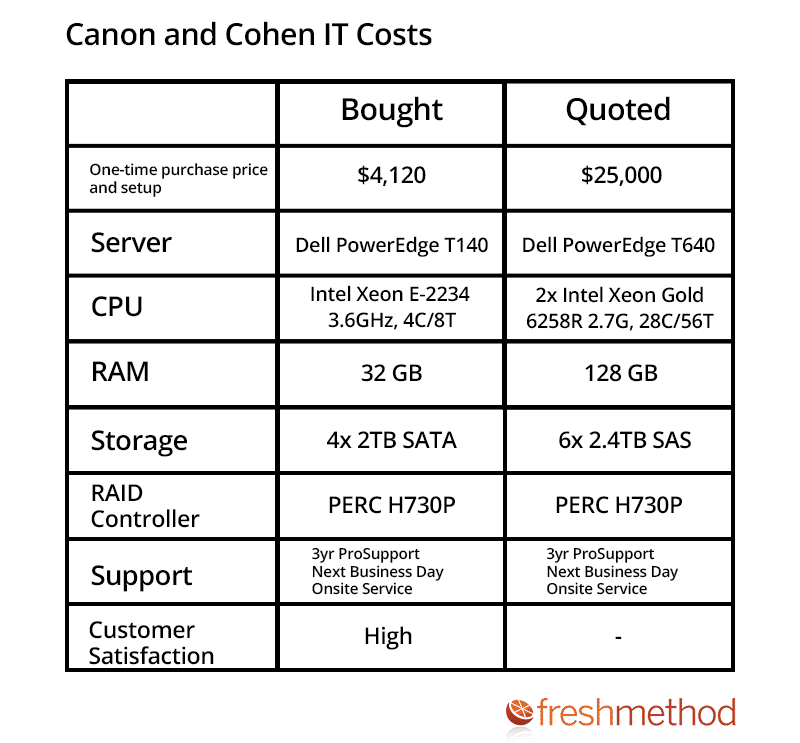

Cannon and Cohen, a Tamworth based accounting firm, were in exactly this situation. They still use MYOB Accountants Office daily for older clients, as well as Xero Practice Manager for the rest of the customer base.

Despite these modest requirements, their IT services provider quoted the firm more than $25,000 for a replacement server. This was closer to the original price of their outgoing server, even though they were no longer relying on it to manage the bulk of their clients.

Cannon and Cohen bought a smaller server that easily met their requirements for just $4,120 – 84% less than the initial quote.

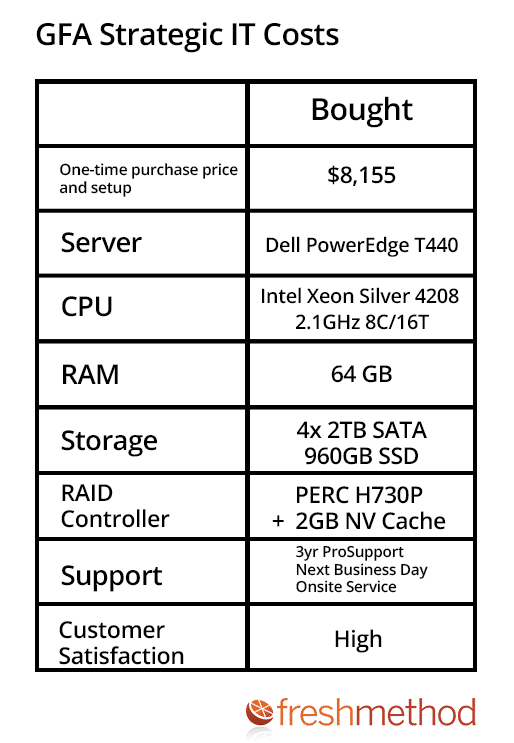

Even firms that are heavily reliant on their server and use it daily don’t need to spend five-figure sums on the latest hardware. GFA Strategic, an eight-staff firm that only uses server-based practice software, moved to a new machine that cost under $10,000. See below.

Read the Case Study for GFA Strategic here.

How Much Server Do You Need?

The key to paying the right price for your server is to get quotes from multiple providers that include the specifications of the server. If an IT service provider can introduce you to customer firms who are happily using a lower-specced machine with a similar workload, then you can buy with confidence.

Otherwise you are probably going to overpay for an autobahn-storming race car that will sit under your office desk or in a hosted data centre, idling in neutral.

Not everyone who overquotes does so intentionally. Often it is just ignorance; IT service providers who don’t have many accounting firms on their books won’t have any useful benchmarks for what is required. Hence, they will be overly cautious and recommend a bigger unit than you need, rather than get an angry call from your firm saying that the server isn’t powerful enough.

Make sure you talk to IT service providers who specialise in the accounting profession. They will have deep benchmarks for the practice software you run, and will be far more accurate at matching the best-priced server to sufficient levels of performance.

If your server is reaching the end of its life and you are trying to work out whether you can retire it or need to replace it, give us a call at Fresh Method for an obligation-free quote and advice on the best direction for your firm.